Qatar Airways has completed Starlink installation on 54 Boeing 777 aircraft, delivering high-speed Wi-Fi onboard. The carrier is now focusing on equipping its Airbus A350 fleet with Starlink, with that work expected to finish within a year. This makes Qatar Airways the operator of the largest number of widebody aircraft equipped with Starlink technology and the only carrier in …

Read More »Yearly Archives: 2025

Starlink on Business Jets: Aero-Dienst Installation Breakdown

Aero-Dienst has successfully integrated Starlink’s LEO satellite internet system onto a Bombardier Global 6000, expanding connectivity options for business aviation operators seeking global coverage. System Specifications: LEO satellite coverage across operational areas Advertised speeds: up to 220 Mbps download, 25 Mbps upload (single-user, optimal conditions) Latency: as low as 99ms in ideal scenarios Installation: Upper fuselage-mounted radome for satellite visibility …

Read More »From Europe to Arabia: How A2G Technology is Challenging Satellite Dominance

SkyFive Arabia: Bringing Ground-Based Aviation Connectivity to the Middle East How air-to-ground technology is transforming inflight connectivity across Saudi Arabia and beyond While much of the aviation industry focuses on satellite-based connectivity solutions, SkyFive Arabia is taking a fundamentally different approach to bringing broadband internet to aircraft across the Middle East and Africa. Through its innovative Air-to-Ground (A2G) technology, the …

Read More »Six Laptops, One User: Why This Demo Misses the Real-World Mark

Impressive demonstration—but let’s talk about real-world conditions. The single-user, multi-device test certainly showcases the system’s raw capability under ideal conditions. However, prospective customers need to understand performance in actual operational scenarios, not laboratory environments. Consider the reality: On a widebody aircraft with 200+ passengers, each potentially running multiple devices simultaneously—streaming video, video conferencing, VPN connections, cloud applications—the network dynamics change …

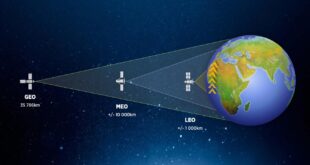

Read More »GEO Isn’t Dead—It’s Just Done Competing on Latency

GEO Satellites Aren’t Dying—They’re Adapting to a Multi-Orbit Future Why geostationary operators who evolve alongside LEO will emerge stronger, not weaker The satellite communications industry is undergoing its most significant transformation in decades. Low Earth Orbit (LEO) constellations have arrived with compelling advantages: low latency, global coverage, and disruptive economics. But the narrative that LEO will replace Geostationary Earth Orbit …

Read More »SmartSky Lands $22.7M Knockout Against Gogo in 5G Patent War

SmartSky Wins $22.7 Million Patent Verdict Against Gogo Over 5G Aviation Technology Delaware jury finds Gogo infringed on air-to-ground transmission patents as separate billion-dollar lawsuit looms SmartSky Networks has secured a significant legal victory against business aviation connectivity provider Gogo, with a US District Court jury in Delaware awarding $22.7 million (€19.6 million) in damages for patent infringement related to …

Read More »Real Aviation Access Performance

When aviation connectivity providers quote speeds and latency figures, they’re showing you best-case, single-user scenarios. But what matters is what you actually experience. Live Performance Testing The PEPsal Performance Dashboard shows you the truth about your connection in real-time: Your Actual Latency – The round-trip time you’re experiencing right now, not the theoretical minimum Baseline vs. Enhanced Performance – Side-by-side …

Read More »NetJets Ditches Gogo for Starlink in 600-Aircraft Connectivity Overhaul

NetJets Makes Major Shift to Starlink for Inflight Connectivity Private aviation giant abandons Gogo rollout in favor of satellite-based solution across 600+ aircraft fleet NetJets, one of the world’s largest private jet operators, has announced a significant pivot in its connectivity strategy, committing to equip over 600 business jets with Starlink’s inflight internet service. The multi-year agreement covers both the …

Read More »Realistic Inflight Speeds on Starlink

At last, a realistic figure… Finally, we’re seeing bandwidth numbers that reflect actual, real-world performance rather than theoretical maximums or laboratory conditions. These figures represent what you can genuinely expect to experience during typical flight operations. Check all the parameters… It’s crucial to examine the complete context of these measurements—including factors such as: Aircraft altitude and speed Number of concurrent …

Read More »Fastapn Accelleration for Aviation

FastAPN: Turbocharging In-Flight Internet Without Hardware Changes In-flight connectivity has come a long way, but even with modern LEO satellites and ATG networks, passengers still face frustratingly slow speeds—especially on high-latency connections like GEO satellites. Enter FastAPN, a clever service that promises to boost aircraft internet speeds up to 15 times faster without requiring airlines to install a single piece …

Read More » In Flight Connectivity Your Source for In-Flight Connectivity Intelligence

In Flight Connectivity Your Source for In-Flight Connectivity Intelligence