Global Avionics Round-Up from Aircraft Value News (AVN)

The aircraft of the future won’t just fly itself…it will taxi itself, too. Autonomous taxiing technology is no longer a science project confined to testbeds and prototypes. It’s now a rapidly advancing reality, and avionics are at the center of the transformation.

As airports develop smarter ground systems and aircraft come equipped with more intelligent control suites, the interoperability between the two is defining new frontiers in fleet value, lease pricing, and operational planning.

For aircraft lessors and appraisers, the question is no longer whether autonomous taxiing is coming. The question is how fast, and how much it matters to the bottom line.

Why Taxiing Automation Is Gaining Ground

Aircraft engines weren’t designed to be ground vehicles. Using them to taxi burns fuel inefficiently, accelerates wear on components, and increases emissions.

A narrowbody aircraft like the A320 burns roughly 500 to 1,000 pounds of fuel during an average 15-minute taxi, depending on conditions. Multiply that by dozens of daily departures across a fleet, and the costs mount quickly.

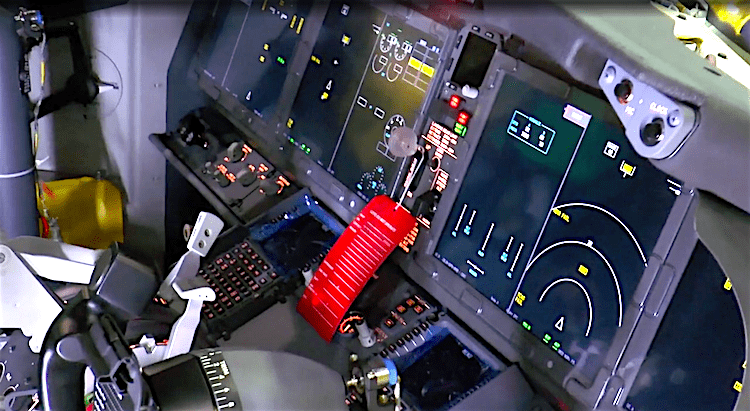

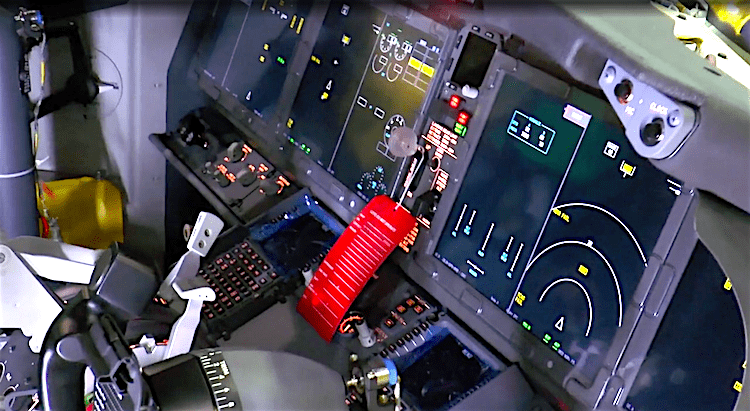

Autonomous taxiing offers an elegant solution. By equipping aircraft with advanced avionics systems that integrate GPS, LIDAR, obstacle detection, and smart braking, manufacturers are making it possible for planes to taxi themselves without pilot input, or at least with far less. Some systems even allow electric motors embedded in the landing gear to handle taxiing, reducing reliance on the main engines entirely.

What started as an emissions reduction tool is now gaining attention as a driver of cost savings, airport efficiency, and aircraft value enhancement.

Smart Airports, Smarter Avionics

Autonomous taxiing doesn’t work in isolation. It requires a two-way conversation between the aircraft and airport ground systems. That means avionics have to be capable of communicating with surface movement guidance systems, runway lighting grids, and even AI-powered traffic control algorithms.

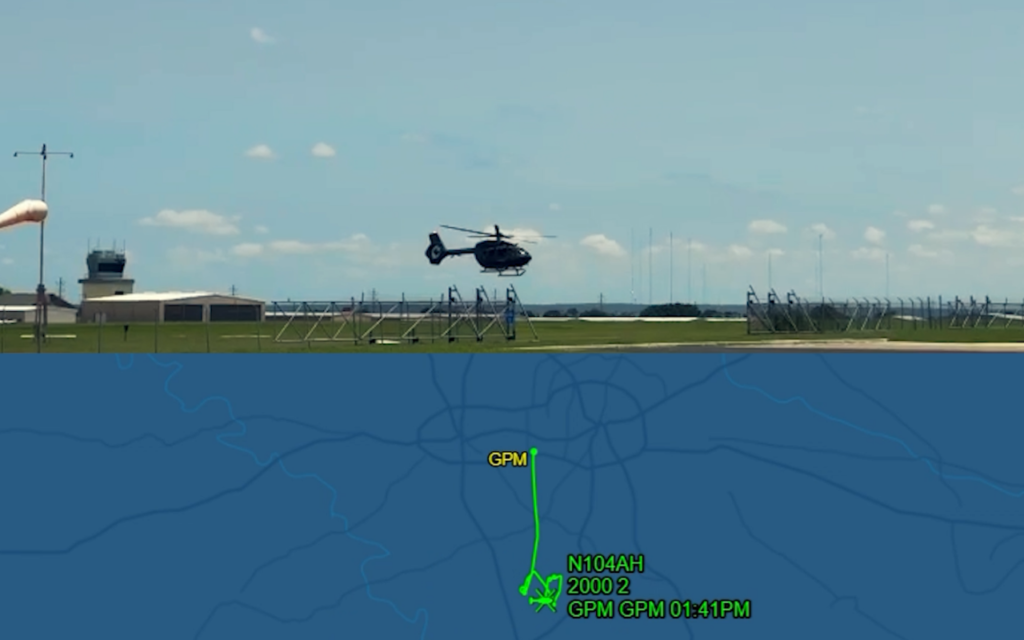

In some test environments, such as Toulouse, Frankfurt, and Singapore, autonomous aircraft are now receiving digital taxi instructions from ground systems, navigating with centimeter-level accuracy, and automatically braking for hazards without human involvement. The onboard avionics interpret taxiway maps, monitor proximity to other vehicles, and respond dynamically to updated clearance routes.

To do this, aircraft must be fitted with avionics suites that are not just GPS-capable but compatible with ground-based digital messaging standards. These avionics systems need to handle rapid data exchange, obstacle detection integration, and precise localization.

Leasing Implications: The Value of Smart Taxiing

Aircraft that support autonomous taxiing are being seen in a new light by lessors and operators focused on cost reduction, sustainability targets, and slot utilization. Ground time is expensive. So is fuel. And in congested airports, every extra minute of taxi time eats into profit margins.

Avionics that enable autonomous taxiing are now considered value-adding. Aircraft equipped with these systems are commanding higher lease rates in regions where smart airport infrastructure is already in place or under construction. Even where full autonomy isn’t available yet, aircraft with modular, upgradable avionics systems are seen as future-proof, making them more attractive in secondary markets.

Preliminary data from leasing benchmarks shows a 2% to 3.5% base value boost for aircraft equipped with autonomous taxi-capable avionics in relevant operational theaters, particularly in Europe and Asia. Operators flying into next-gen airports that support these systems are achieving shorter turnaround times, which in turn raises aircraft utilization rates, a key metric for lessors.

Retrofitting: A Cost with Return

While new-production aircraft can be ordered with autonomous-ready avionics, retrofitting is the path forward for much of the existing fleet. This includes installing enhanced sensor packages, integrating digital surface maps, and modifying flight control software to handle low-speed maneuvering under computer guidance.

The retrofit cost varies widely depending on aircraft type and age, but the payback period is shrinking. Reduced fuel burn during taxi, fewer tug operations, and shorter turnarounds create real savings. For lessors, aircraft that have undergone this upgrade are increasingly seen as differentiated assets, particularly when offered with full airport certification for smart ground movement systems.

Some MRO shops now offer bundled avionics and certification packages, targeting operators and lessors looking to position their fleets for long-term viability in a smart-airport world. As adoption grows, appraisers are expected to treat autonomous taxiing capability as a separate value line item, similar to how ETOPS or RNAV capabilities are modeled today.

Ground Infrastructure: The Other Half of the Equation

The aircraft can’t taxi smartly without help from the ground. That’s why airports are upgrading their own infrastructure, adding digital signage, sensor arrays, and edge computing systems capable of directing and verifying autonomous aircraft movements.

These improvements come with new data-sharing protocols that avionics must support, such as A-SMGCS (Advanced Surface Movement Guidance and Control System) and D-Taxi (data-linked taxi clearance systems).

Airport-aircraft interoperability is becoming a key point in lease planning. Aircraft that can plug into these upgraded systems can operate more efficiently. In some cases, these aircraft can even avoid delays tied to legacy infrastructure. In places such as Munich and Incheon, airports are beginning to favor airlines with compatible fleets when assigning slots and gates, further incentivizing investment in smart avionics.

Lessors are increasingly factoring in some aircraft’s “airport compatibility index,” informally speaking. A narrowbody that can be cleared to taxi by datalink in five major hubs is more appealing than one that can’t, even if it’s mechanically identical.

Operational Benefits Beyond the Cockpit

There’s also a safety argument to be made. Autonomous taxiing reduces the likelihood of ground collisions and runway incursions, especially in low-visibility conditions. Systems designed to automatically stop an aircraft short of an active runway or misaligned taxiway aren’t just smart; they’re also insurance against disaster.

Flight crews benefit too. Rather than relying on visual cues, they receive digitally mapped routes and real-time feedback from onboard systems. These innovations reduce pilot workload and increase situational awareness, which in turn lowers the risk of costly errors.

For cargo operators, the benefits are even greater. Precision taxiing means tighter scheduling and less idle time on the ground, both of which translate directly into better ROI on each flight cycle.

This article originally appeared in Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News.

The post Cleared to Roll: How Autonomous Taxiing and Smart Avionics Are Shaping Aircraft Values appeared first on Avionics International.

—————

Boost Internet Speed–

Free Business Hosting–

Free Email Account–

Dropcatch–

Free Secure Email–

Secure Email–

Cheap VOIP Calls–

Free Hosting–

Boost Inflight Wifi–

Premium Domains–

Free Domains