Embraer’s Avionics Upgrades Signal the Ascent of Regional Aviation

Global Avionics Round-Up from Aircraft Value News (AVN)

Embraer Phenom 300 aircraft.

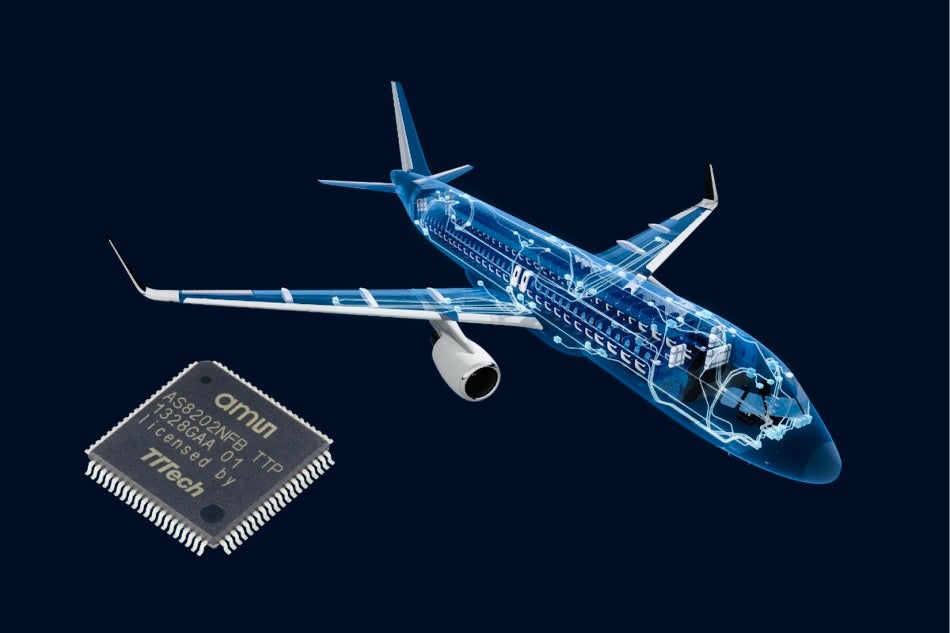

Embraer is steadily redefining what pilots and passengers expect from smaller aircraft. Thanks to cutting-edge cockpit/avionics innovations, especially in its regional and business jet lines, the Brazilian manufacturer is helping to shift the center of gravitas in aviation toward regional operators.

Here’s a look at the latest avionics advances in Embraer cockpits. They’re more than just tech innovations; they’re emblematic of regional aviation’s rise.

What’s New in the Cockpit

- ROAAS & Stabilized-Approach Systems

The new Phenom 100EX introduces a Runway Overrun Awareness and Alerting System (ROAAS), a feature that predicts whether the aircraft can safely stop on an available runway by analyzing speed, altitude, attitude, environmental conditions, and runway length. Alongside ROAAS, there’s a stabilized approach monitoring system standard on the 100EX. For single-pilot jets especially, these tools act like a second set of eyes during one of the flight’s most critical phases.

- Autothrottle for the Phenom 300E

Building on its Prodigy Touch flight deck (which uses the Garmin G3000 avionics suite), Embraer is adding an autothrottle option to the Phenom 300E. This reduces pilot workload, smooths out transitions between phases of flight—climb, cruise, descent—and enhances safety by helping manage speed more precisely. It’s especially valuable in challenging airspaces or for operators who fly many short legs.

- Predictive Safety and Maintenance Tools

Embraer’s AHEAD (Aircraft Health and Event Analysis & Diagnostics) system is now more mature, offering predictive maintenance across its executive (and commercial) jets. Real-time data from sensors and health monitoring systems helps spot potential failures before they ground an aircraft or cause delays.

Embraer is installing Universal Avionics’ KAPTURE Cockpit Voice & Flight Data Recorder (CVFDR) system on its E-Jet 170/175s. This upgrade increases voice/data recording capacity to 25 hours, captures data-link communications, and provides some backup power to preserve critical flight data in the event of power loss.

Better Connectivity, More Informed Decisions

Newer models like the E-Jets are getting enhanced weather radar systems, improved data transfer solutions, and multi-band satellite connectivity (Ku and Ka band) options. For regional operators, that means flights that are safer, more predictable, better connected, and more resilient in the face of adverse weather or air traffic constraints.

When small-jet or regional operators often fly single-pilot or small-crew configurations, automation and decision-assistance tools become disproportionately valuable. ROAAS, stabilized-approach alerts, autothrottle—each reduces human error risk at the margins, increasing safety without overburdening the crew.

Regional aviation often means many short flights, tight turnarounds, lots of takeoffs/landings—every element of inefficiency counts. Improved avionics help here: autothrottle improves fuel efficiency and speed management; predictive maintenance reduces unplanned downtime; weather/radar upgrades reduce delays or diversions.

Upgrades like the 25-hour recorder, compliance with newer FAA/EASA/EUROCAE standards, and advanced safety tools position Embraer operators to meet evolving regulatory requirements with less retrofit cost, making fleets more future-proof.

These cockpit innovations are not happening in isolation; they are part of, and helping to fuel, a broader expansion of regional aviation. Embraer itself forecasts demand for 10,500 new aircraft under 150 seats over the next 20 years.

As aircraft get smarter, more efficient, and safer even in smaller platforms, the case for scaling up regional networks becomes stronger.

This article originally appeared in Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News.

The post Embraer’s Avionics Upgrades Signal the Ascent of Regional Aviation appeared first on Avionics International.

—————

Boost Internet Speed–

Free Business Hosting–

Free Email Account–

Dropcatch–

Free Secure Email–

Secure Email–

Cheap VOIP Calls–

Free Hosting–

Boost Inflight Wifi–

Premium Domains–

Free Domains