Airbus Helicopters CEO Gives eVTOL Updates, 2022 Market Outlook at Heli-Expo

A light-utility twin-engine H135, featured at the Airbus booth at HAI Heli-Expo in Dallas, Texas.

DALLAS, TEXAS — CEO of Airbus Helicopters, Bruno Even, and President of Airbus Helicopters Inc., Romain Trapp, shared their perspectives on the company and their progress in a press conference at HAI Heli-Expo this week. Bruno Even noted that Airbus Helicopters received €8.5 billion in order intakes, as well as €6.5 million in revenue, in 2021. He believes that the market should recover fully from the effects of the COVID-19 pandemic within the next 2–3 years and that the market is about 40% recovered so far. “Our strategy to continually invest in the product pays off when it comes to marketing positioning and proximity to customers,” he remarked. Even also mentioned the positive momentum that Airbus Helicopters envisions for the market in the Middle East, particularly in Saudi Arabia.

Airbus has agreed to expand their partnership with The Helicopter Company to advance helicopter operations, using sustainable aviation fuel (SAF) for conventional helicopters, and bringing urban air mobility (UAM) to Saudi Arabia. The Helicopter Company (THC) already operates ten of Airbus’s H125s and recently added 20 H145s to its fleet, as well as six ACH160 helicopters. Through this expanded partnership, and in coordination with the local regulatory authorities, helicopters and other urban air mobility (UAM) vehicles will be used for applications in Saudi Arabia including emergency medical services, ecotourism, and private and business aviation.

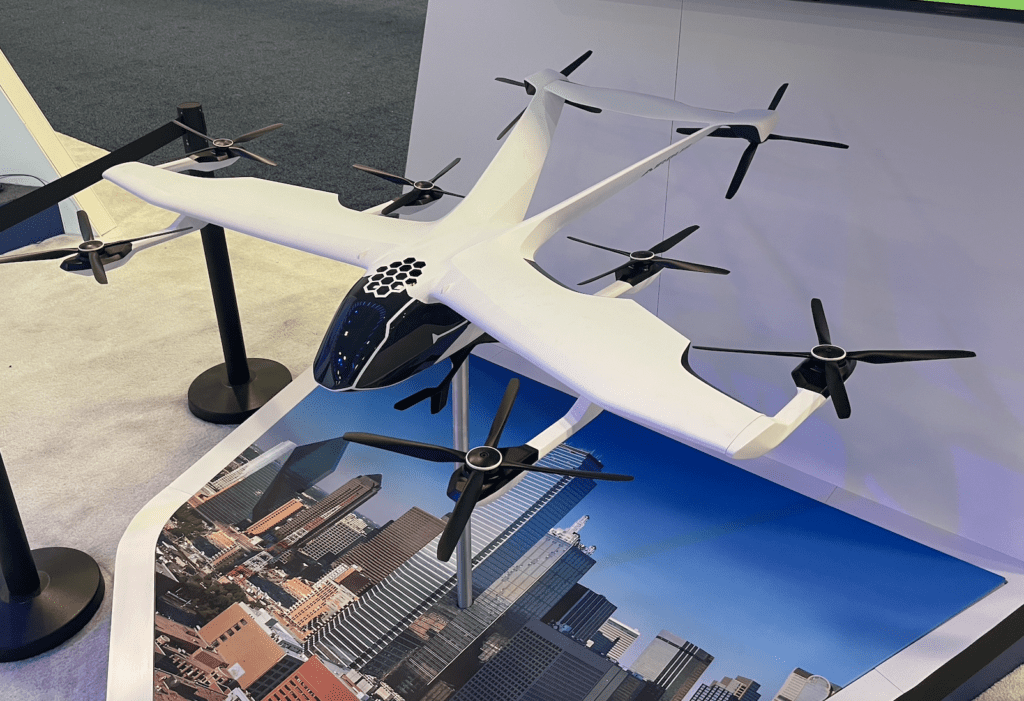

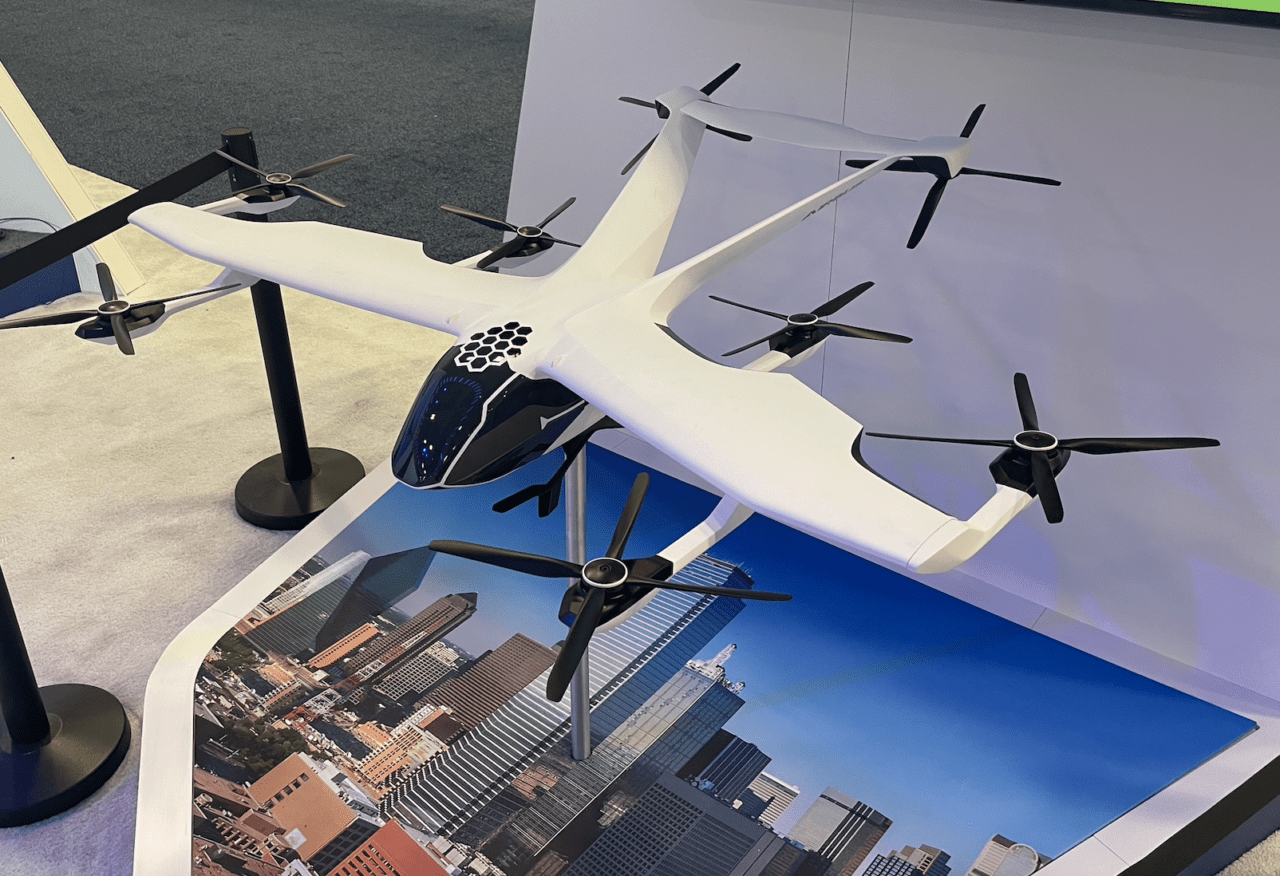

Airbus also announced this week that Spirit AeroSystems, aircraft components manufacturer and architecture solutions provider, has agreed to develop and manufacture the wings of the CityAirbus NextGen, an electric vertical take-off and landing (eVTOL) prototype. The CityAirbus NextGen is fully electric, and its design includes fixed wings and a V-shaped tail, along with eight electrically powered propellers. Spirit AeroSystems has provided fully integrated wings and wing elements for multiple Airbus commercial aircraft in the past. According to the announcement from Airbus, “The structural concept of the eVTOL’s fixed wings will be able to transmit the related aerodynamic loads while being optimized for the right balance between hover and cruise efficiency. CityAirbus NextGen’s distributed propulsion system will contribute to reducing the influence of air turbulence.”

A model of the CityAirbus NextGen on display at HAI Heli-Expo

At the press conference this week, Even commented that it is key for Airbus Helicopters to maintain balance between their sources of revenue; for example, with military and civil markets, 56% of revenue comes from the military side and 44% comes from the civil market. Additionally, 44% of revenue is from services, and 56% of revenue results from the company’s products. “Our strategic priorities for the next year are customer loyalty, innovation and sustainability, and defense and security,” he stated. “We will continue to invest and innovate in our existing helicopters and in new versions of the vehicles.”

Romain Trapp remarked on the outlook for Airbus Helicopters, explaining that they expect significant growth for the company in 2022. Their staff has increased by 10% in the past nine months and they plan to continue growing quickly in the future.

Along with the rest of the aviation industry, Airbus Helicopters is pursuing carbon neutrality by 2050. Even said, “It will be a step-by-step approach. In the short term, the best way to address it is to start introduction of helicopters with sustainable aviation fuel. We demonstrated last year with the H225 that helicopters can fly with 100% SAF. We are convinced that SAF is the best way to contribute to reduction of emissions in the short-term.”

One challenge, he said, is that sustainable aviation fuel (SAF) is more expensive now than conventional fuel. However, with the company’s focus on sustainability at the core of their mission, they expect to be able to use 100% SAF in their aircraft in the relative short term. Even also commented that while hydrogen-powered aircraft have many advantages, there are also limitations, and it is not the company’s first priority to develop hydrogen-powered helicopters.

Inside an H125 helicopter on display at Heli-Expo

Airbus also highlighted some recent developments in improving safety for its single-engine helicopters. “Improving aviation safety while boosting the competitiveness of our products is one of our top priorities at Airbus Helicopters. With the H125 having raised the bar to unprecedented levels in terms of performance and value for money, Airbus Helicopters has also worked in the last year to bring several new features which will significantly enhance the flight safety of the H125 and the H130,” according to Airbus.

For the H130 helicopter, a brand-new instrument panel is now available, including a new Garmin G500H TXi touchscreen main flight display, com/nav radio GTN650Xi, creating an improved human-machine interface in the cockpit for pilots.

The screen on the upper right-hand side is the Garmin G500H TXi touchscreen main flight display.

The post Airbus Helicopters CEO Gives eVTOL Updates, 2022 Market Outlook at Heli-Expo appeared first on Aviation Today.

—————

Boost Internet Speed–

Free Business Hosting–

Free Email Account–

Dropcatch–

Free Secure Email–

Secure Email–

Cheap VOIP Calls–

Free Hosting–

Boost Inflight Wifi–

Premium Domains–

Free Domains