Global Avionics Round-Up from Aircraft Value News (AVN)

(Photo: ICAO)

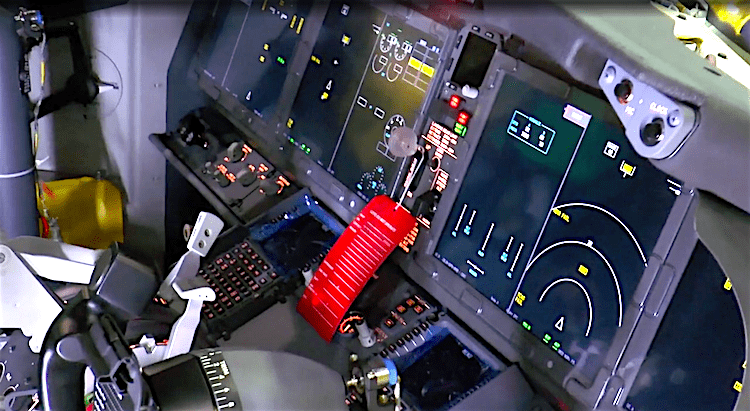

Cybersecurity is no longer a back-office concern for airlines and aircraft operators. It has become a frontline issue, with the rise of sophisticated digital threats targeting avionics systems directly affecting flight safety.

Among the most alarming of these threats is GPS spoofing, a form of digital manipulation where false signals are sent to aircraft navigation systems.

These attacks have the potential to mislead pilots and automated systems, steering planes off course. In most cases, the disruption can be managed with timely intervention from Air Traffic Control, but the growing frequency of incidents has industry experts sounding the alarm.

Recent data from the OpsGroup, a membership organization dedicated to international flight operations, highlights just how steep this surge has become. According to their latest figures, the number of GPS spoofing incidents has increased by a staggering 400% so far this year. That translates to roughly 900 flights encountering potential GPS interference each day.

The sheer scale of this increase raises the stakes for operators, regulators, and passengers alike, and signals that traditional risk mitigation strategies may no longer be sufficient on their own.

GPS spoofing is just one facet of a broader wave of cyber threats targeting aviation. The digital transformation of airlines, airports, and air traffic systems has created new vulnerabilities, and cybercriminals are taking notice.

According to research conducted by cybersecurity services firm Bridewell, more than half of civil aviation cybersecurity leaders in the United States—55%—reported experiencing ransomware attacks over the past year. These attacks can lock critical systems, threaten operational continuity, and demand significant financial or data concessions to resolve.

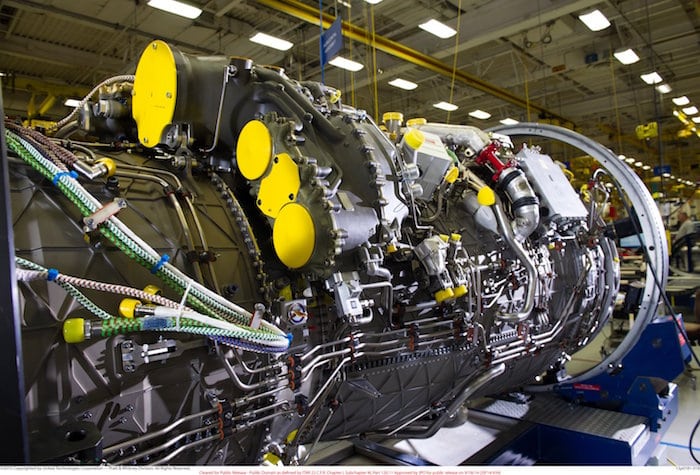

The industry’s growing dependence on digital technology and automation has intensified the consequences of such attacks. Modern aircraft rely on interconnected systems for everything from navigation to engine monitoring, and airlines increasingly use cloud-based platforms for maintenance scheduling, crew management, and passenger services.

Any breach in these systems can ripple across operations, creating delays, financial losses, and potential safety hazards. For operators, the challenge is not only detecting and responding to cyber incidents but also anticipating and preventing them before they occur.

Cybersecurity Investments on the Rise

To meet these challenges, aviation organizations are scaling up their cybersecurity investments. Bridewell’s survey indicates that 72% of respondents plan to increase IT security budgets compared with the previous year, with much of that funding devoted to creating protections for avionics.

This surge in spending reflects a recognition that cybersecurity is now a core component of operational safety rather than a peripheral concern. Airlines and operators are deploying a range of solutions, from advanced firewalls and intrusion detection systems to real-time monitoring tools capable of identifying unusual activity in avionics networks.

Artificial intelligence has emerged as a key ally in this effort. According to the same survey, 98% of aviation cyber decision-makers are now leveraging at least one AI-driven tool to bolster their defenses.

These systems can analyze vast amounts of data from flight operations, detect anomalies, and provide predictive insights, helping operators identify potential threats before they escalate. AI is particularly useful in addressing GPS spoofing attacks, where subtle deviations in navigation signals can be difficult for human operators to detect in real time.

The convergence of digitalization and cybersecurity investment is creating a new paradigm in aviation operations. Aircraft systems are becoming smarter and more interconnected, while security frameworks are evolving to match.

Operators are beginning to view cybersecurity as an integral part of avionics design, rather than a reactive add-on. Industry collaboration is also expanding, with regulators, aircraft manufacturers, airlines, and cybersecurity firms sharing threat intelligence and best practices to strengthen defenses across the aviation ecosystem.

Despite these efforts, experts caution that cyber risks will continue to evolve. GPS spoofing methods are becoming more sophisticated, ransomware actors are constantly refining their tactics, and the rapid adoption of new digital tools can inadvertently introduce additional vulnerabilities. This makes continuous vigilance and investment critical.

For aviation stakeholders, the focus is shifting from simply responding to attacks toward creating resilient systems capable of absorbing and mitigating threats while maintaining operational continuity.

The stakes are high because the consequences of a cyber incident in aviation can extend far beyond delayed flights or financial losses. Safety, public confidence, and international air traffic stability are all on the line. As the industry continues to digitalize, ensuring robust cybersecurity measures is no longer optional. It is a strategic imperative that requires sustained investment, innovation, and collaboration.

In this new environment, the line between traditional avionics engineering and cybersecurity expertise is blurring. Protecting aircraft and passengers now depends as much on software, data analytics, and AI-driven defense systems as it does on engines, wings, and navigation instruments.

The rise in GPS spoofing and ransomware attacks underscores the reality that modern aviation operates in a digital sky that must be defended as rigorously as its physical one.

The aviation industry is learning that staying ahead of cyber threats is not a temporary project but a continuous mission. Airlines, manufacturers, and regulators are increasingly aligned in their efforts to create resilient systems, enhance detection capabilities, and embed cybersecurity into every aspect of flight operations.

This article originally appeared in Aircraft Value News.

John Persinos is the editor-in-chief of Aircraft Value News.

The post Sky Under Siege: Digital Attacks Forcing a New Era in Avionics Cybersecurity appeared first on Avionics International.

—————

Boost Internet Speed–

Free Business Hosting–

Free Email Account–

Dropcatch–

Free Secure Email–

Secure Email–

Cheap VOIP Calls–

Free Hosting–

Boost Inflight Wifi–

Premium Domains–

Free Domains