Experts Discuss Investment Opportunities for Advanced Air Mobility in Australia

Last week’s Advanced Air Mobility Summit, hosted by the Australian Association for Uncrewed Systems, featured discussions on investing in the growing AAM industry in Australia. (Photo: Australian Association for Uncrewed Systems)

Significant investments into advanced air mobility are required to support a growing sector that will include autonomous vehicles, drones, and eventually electric vertical take-off and landing (eVTOL) aircraft. These vehicles will all operate in the same airspaces. In addition to an air traffic management system that accounts for unmanned aircraft, investment will also be needed for infrastructure development.

The Australian Association for Uncrewed Systems (AAUS) hosted a summit on advanced air mobility, or AAM, last week. Experts from NEXA Capital Partners, Ferrovial Vertiports, and Swinburne University discussed the unique opportunities for investment into AAM in Australia, along with some of the challenges.

Clem Newton-Brown—the CEO of Melbourne based startup Skyportz that aims to develop a network for eVTOLs—remarked during the AAM Summit that future eVTOL operations will require a very capital-intensive investment to establish sufficient ground infrastructure. “We’re after about 400 sites that we have options on,” he remarked in reference to Skyportz.

Newton-Brown and other industry leaders in Australia believe it is urgent to establish the country as an early mover for AAM and to attract OEMs. “We’ve attracted the Wing [drone] delivery service,” he mentioned. “They came here because it was a better spot for them to trial their delivery service than elsewhere.”

He continued: “The danger for Australia is that the [AAM] industry starts in other cities, and the demand for aircraft will be such that we won’t even get our hands on aircraft [in Australia].”

Investment banking firm NEXA Capital Partners identifies and finances early-stage AAM infrastructure, as it has with other aviation industry technologies and initiatives in the past. They are currently looking at the viability and financial strength of different markets for AAM. During last week’s summit, Michael Dyment, Managing Partner at NEXA, commented on the unique ecosystem that Australia offers for eVTOL operations and drone services. “The market represented by some of the cities in Australia, and in particular southeastern Australia, create the opportunity to get ahead of the industry globally,” he explained.

NEXA’s subsidiary for AAM research, UAM Geomatics, has analyzed the AAM business case for the 84 largest cities in the world and identified the industry as a trillion-dollar market.

“The analysis is driven by some very rigorous tools that give us the opportunity to examine the long-term profitability of this new industry sector in given metropolitan areas of the world,” including Sydney and Melbourne, said Dyment.

NEXA used data from UAM Geomatics to forecast the potential revenue from AAM in Sydney, estimating about $4 billion in potential future revenue. AAM ground infrastructure for the city is estimated to require $136 million to establish a complete network, including charging stations and vertiports. Low-altitude air traffic control for Sydney will cost another $100 million in investments.

Dyment remarked that advanced air mobility can be financed largely through private investments. An industry’s revenue to cost ratio is used to indicate how easy it will be to attract private-sector capital. A ratio of at least 2.5 or 3 generally signals that attracting private-sector capital will be easy, he noted.

The role of the government, in contrast, should be to facilitate the regulatory side of things and then allow private capital to fund AAM development, according to Dyment.

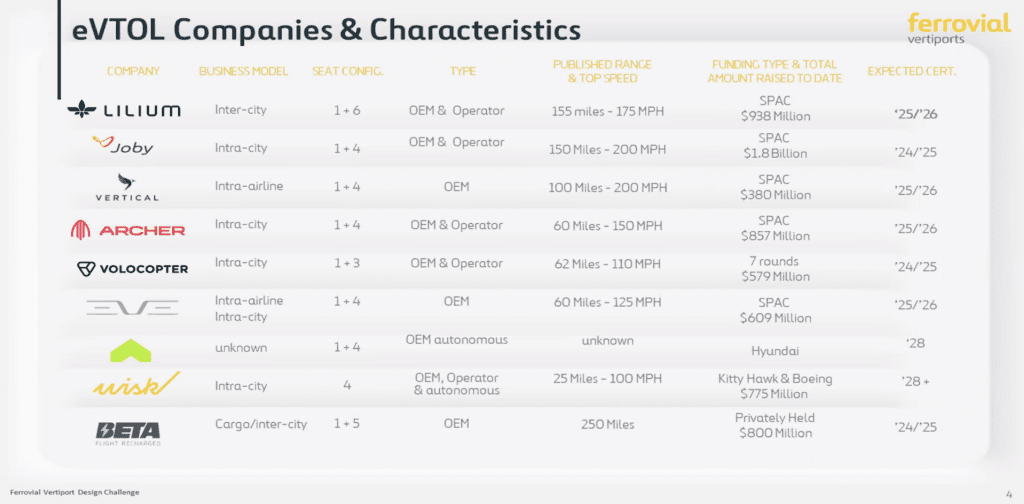

Kevin Cox, CEO of Ferrovial Vertiports, commented during the AAM Summit that Ferrovial has created a sophisticated demand model to predict where the best business opportunities will be in regards to transportation and infrastructure. Cox and the company are confident that some eVTOL companies will achieve certification in late 2024 and early 2025.

During the AAM Summit, Kevin Cox, CEO of Ferrovial Vertiports, shared the above chart of some of the top eVTOL developers, according to the company. (Photo: Kevin Cox/Ferrovial Vertiports/AAUS AAM Summit)

Ferrovial Vertiports, which is planning to build a network of vertiports across the U.S. and Europe, is taking an agnostic approach to the eVTOL industry. “We support and converse with all these companies,” stated Cox. “This industry will not take flight without a lot of people working collaboratively together.”

He went on to explain that there are likely three key business models for eVTOL aircraft:

- Intra-City: routes less than 50 kilometers, high volumes of operations in densely populated areas (such as Joby)

- Intra-Airline: routes between 50 and 150 km, pioneered by helicopter operators

- Inter-City: routes up to 300 km, point-to-point operations (such as Lilium)

Kevin Cox also noted the importance of finding cost-effective locations for setting up vertiports. “Allowing for everybody to utilize our vertiport is absolutely critical; we don’t need to reinvent the wheel,” he said. At the same time, it is important to take a more innovative approach in the design of vertiport networks rather than replicating current airport setups. “If it feels, looks, and operates like an airport, then we have failed,” he added.

The Ferrovial Vertiports CEO emphasized the importance of having a long-term vision in mind for innovative concepts before investing millions or billions of dollars into something like the autonomous aircraft that Wisk (and others) are working on.

Advanced air mobility represents a strategic baseline for the future technology economy in Australia, according to Dr. Adriano Di Pietro. He is the director of Swinburne University’s Aerostructures Innovation Research (AIR) Hub, a research and industry collaboration funded by the Victorian government. Dr. Di Pietro remarked that AAM depends on the existing capabilities and ecosystem of the civil aerospace sector. “We have a strong capability here in Australia, and particularly in Victoria,” he said. “We see opportunity in the supply chain, as well as the technology and exports.”

However, he noted, it’s important to look internationally—and particularly from a technology point of view—to ensure the growth of AAM in Australia.

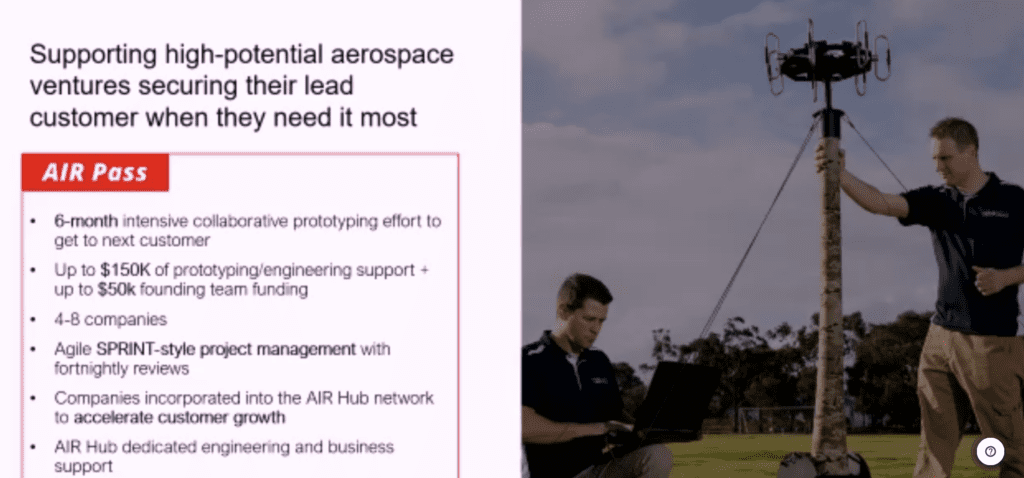

The AIR Hub at Swinburne University developed the AIR Pass program to support prototyping and technology for early-stage aviation and aerospace ventures as well as to provide financial support. (Photo: Dr. Adriano Di Pietro/AAUS AAM Summit)

The AIR Hub supports three main strategies for driving the AAM industry, including creation of a clear policy environment, leadership in key technologies and capabilities, and development and scaling of the market.

The research done at the AIR Hub is industry-led, and designed to benefit industry directly. Some of the partners include Boeing, Quickstep, Cablex, and Marand. “We’re also working with a number of subject matter experts as well as national research partners like ANSTO and Monash University,” Dr. Di Pietro said. They have also formed a partnership recently with NIAR, the National Institute for Aviation Research, at Wichita State University.

“Australia needs coverage and investment across all categories of the ecosystem,” he added. “We need to hone the skills of future engineers and we need a strong supply chain. And we need to fly every day and undertake persistent trials to support AAM here.”

The post Experts Discuss Investment Opportunities for Advanced Air Mobility in Australia appeared first on Aviation Today.

—————

Boost Internet Speed–

Free Business Hosting–

Free Email Account–

Dropcatch–

Free Secure Email–

Secure Email–

Cheap VOIP Calls–

Free Hosting–

Boost Inflight Wifi–

Premium Domains–

Free Domains